Peer-to-Peer Trading, Block reward, Stop Order

The Rise of Cryptocurrencies and Peer-to-Peer Trading: Understanding the Basics

As the financial world continues to evolve, cryptocurrency trading is becoming more and more prominent. Cryptocurrencies such as Bitcoin and Ethereum have gained popularity over the years due to their decentralized nature, security, and potential for high returns.

Cryptocurrency Trading Overview

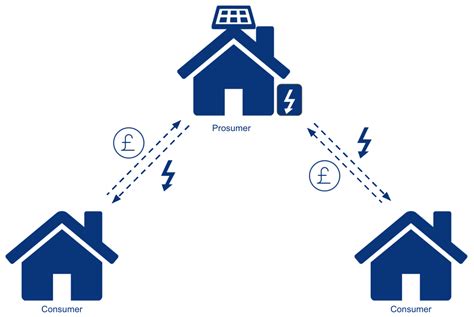

Cryptocurrency trading involves buying and selling cryptocurrencies on online exchanges or platforms. These transactions are usually carried out through peer-to-peer (P2P) models, where individuals trade with each other without intermediaries such as brokers or financial institutions.

One of the most important aspects of cryptocurrency trading is the concept of block rewards. When a transaction occurs on a blockchain network, such as Bitcoin’s proof-of-work consensus algorithm, a new block of transactions is created. In exchange for verifying and adding these transactions to the blockchain, a miner (computer) is rewarded with newly minted cryptocurrency.

Block Reward Structure

The block reward structure plays a crucial role in understanding how cryptocurrencies are created and transferred. The reward is determined by the Proof-of-Work (PoW) consensus algorithm used in most cryptocurrencies. In PoW, nodes on the network compete to validate transactions and create new blocks. The first miner to solve a complex mathematical puzzle is rewarded with newly minted cryptocurrency.

The block reward structure typically includes several components:

- Mining difficulty: A measure of how difficult it is for miners to solve the mathematical puzzle.

- Block reward: The number of new coins awarded to the miner.

- Transaction fee

: A fee paid by users for transactions within a block.

- Gas price: The cost of using the network’s energy resources.

Stop Orders in Cryptocurrency Trading

A stop order is an automated trading instruction that can be executed at a predetermined price or market conditions. It acts as a safety net to limit potential losses and lock in profits.

In cryptocurrency trading, stop orders are typically used to:

- Set limit buy: Place a buy order at the current market price.

- Set limit sell: Place a sell order at the current market price.

- Stop loss: Automatically execute a sell order when the market price reaches or falls below a certain level.

To set up a stop order in cryptocurrency trading, you need to:

- Select trading platform: Choose an online exchange or platform that supports stop orders.

- Set order type: Choose whether you want limit buy or limit sell.

- Enter Stop Price: Specify the price at which your stop order will be executed.

Example of Using a Stop Order

Let’s say you are trading Bitcoin and set up a stop order to buy 10 units when the market price reaches $40,000. If the price falls below $39,500 within two hours, your stop order will automatically execute the trade and buy 100 units at the current market price.

Conclusion

Cryptocurrency trading and peer-to-peer trading offer a new level of financial freedom and flexibility. Understanding block rewards and stop orders is essential to navigating the world of cryptocurrency trading. By understanding these concepts, individuals can make informed decisions about their investments and maximize their returns in this rapidly evolving market.